In April 2012, economist Robert Wenzel[1] was invited to speak at the Federal Reserve Bank of New York. On the occasion, he told the central bankers that “vast amounts of money printing are now required to keep your manipulated economy afloat. It will ultimately result in huge price inflation, or, if you stop printing, another massive economic crash will occur. There is no other way out.”[2]

Continue readingCategory Archives: Asset management

Bear market or bubble reflation: what comes next?

In March last year, I published an article looking at historical perspective on boom/bust cycles in SeekingAlpha. I suggested then that, “the (still) festering economic imbalances might get resolved along two alternative scenarios. Either we’ll have a full-blown deflationary depression that could see asset prices drop by 50% or more, or we’ll have a strong and sustained decline in the US Dollar, ” accompanied with a continued rise in equity markets. Today, the latter scenario appears more likely. Here’s why: Continue reading

With I-System through March storm – part 2

March 2020 market storm has been an important test of the I-System model and the way it navigated the unforeseen events. The results have been very encouraging and the system has done well in all affected markets. Last week I summarized its performance on Brent crude oil, Silver and US 30-year Bond. Here we take a look at how it performed in Russell 2000, S&P500 and Palladium markets. Continue reading

With I-System through the storm… with flying colors!

Recent weeks brought severe price shocks in many markets. Their timing and severity took most participants by surprise. In these circumstances, I-System strategies performed superbly well. As this post shows, a few strategies sustained negative results, but this is to be expected. This is why, rather than formulating a trading strategy, we built a stable knowledge framework so that we can formulate and implement literally thousands of strategies within that framework. In this sense I-System holds potential to entirely transcend uncertainty by supplanting it with a more predictable risk class: a swarm of consistent, intelligent and emotionless trading agents, each in charge of a small fraction of portfolio risk. The current experience was an important test for the I-System. The results speak for themselves. Continue reading

Market panics and trend following

Today global capital markets opened to unprecedented price dislocations. ZeroHedge captured the mood: “Panic Purgatory: Oil Crashes to $27%; S&P Futures Locked limit Down, Treasuries Soar Limit Up Amid Historic Liquidation.” Over the recent months I’ve posted many articles on this blog and on SeekingAlpha, basically along two themes:

1) Warning that the markets would experience great turbulence in the near future (see here: “Perfect Storm Gathering…” and

2) Suggesting that the best way to navigate through the storm is by using high-quality systematic trend following strategies (see here, “Trend Following Might Save Your Tail“).

It may be that the time of reckoning has begun But if you followed my advice and used systematic trend following, most likely you’d be having a good day today. The chart below illustrates the net positioning of my 493 I-System strategies at market open this morning: Continue reading

In October 2019 I predicted the current oil price collapse. How I knew? Here’s how:

In January last year, Reuters polled 1,000 oil market experts who basically agreed that oil would remain anchored in the $65-$70/bbl range through 2023. Only 3% of these experts thought that oil might rise to $90/bbl or more in 2020. I posted my analysis at this link: Market Fundamentals and Forecasting Groupthink. Later that year I published my own analysis, “Next Move in Oil Prices: $5-$10 Lower,” concluding that, …oil price will likely see another leg down… with Brent falling toward high $40s and WTI toward low $40s. Continue reading

Sack your quant!

Last few years saw something of a gold rush into quantitative investment strategies. Their appeal is obvious as a way to put discipline into trading and take the emotion and stress out. Quantitative strategies might even help improve performance. Here’s how Black Rock President Rob Kapito articulated the industry hopes:

“As people get the data and learn how to use the data, I think there is going to be alpha generated and, therefore, will give active managers more opportunity than they‘ve had in the past to actually create returns.” [1]

In pursuit of the great expectations, Black Rock assembled more than 90 scientists, 28 of them with PhDs and even went as far as poaching one of Google’s leading scientists, Bill McCartney to develop the BlackRock’s machine learning applications. In practice Black Rock’s and other firms’ results have proven to be a mixed bag at best and it seems that most quantitative strategies have tended to underperform or even generate losses. The question is, why? Continue reading

Trend following and the impact of unforeseen events

“Yes, but how can your system know if XYZ happens and markets go haywire?” This is one of the two most frequently asked questions about systematic trading strategies I’ve used over the last 20 years. Most traders tend to rely on analyses of supply and demand fundamentals to form a judgment about future price changes.

My contention is that this simply does not work and I can make a strong case to back this up (see here, here or here). I can also offer evidence that my systematic approach does work (see here or here) even if I know nothing about the supply and demand economics of most markets I cover. This usually elicits the objection that my system can’t know if some XYZ event might happen tomorrow (recently, XYZ tended to refer to Trump tweets), upsetting the markets and rendering my strategies ineffective. Recent experience afforded me an (almost) perfect answer to this question (plus another important issue related to trend following). Continue reading

Do trend followers move markets? (they do).

A few months ago, when reviewing our trades on US Treasury futures, I was so delighted, I drafted a bragging article titled “How we knew yields would collapse?” summarizing the results of our trading. That performance was entirely generated by my I-System model, first built in 1999. I still find myself awestruck that this works… We generated profitable trades through both the bear and the bull market in bonds, literally without needing to know a single thing about the market fundamentals. The trades were strictly based on the knowledge framework built into the system more than 20 years ago (by the way, our strategies are still generating excellent signals in those same markets). Continue reading

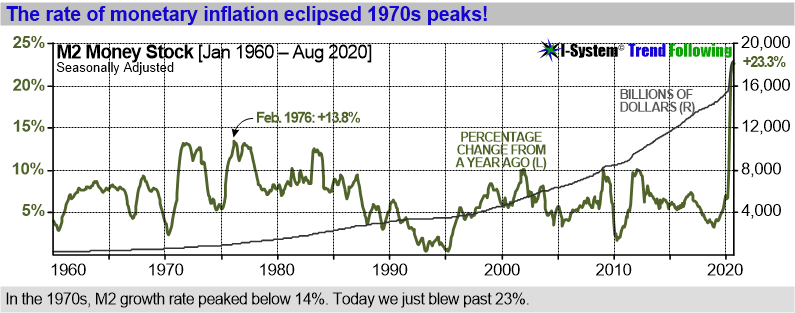

The one force moving stock prices and what it tells us about the future

Back when I traded stocks in late 1990s, I got a gnawing suspicion that beyond the nonstop noise of the news flow, there was some force pushing the rising tide, but I couldn’t discern what it was. By today I think I worked it out. The most surprising thing about it is that it’s been so hard to work out.

Stocks are principally driven by money supply

The first time I encountered an explicitly formulated hypothesis that justified my suspicions was years later while I researched for my book, “Grand Deception.” The hypothesis, relating to Russian stocks, was articulated by Bill Browder, CEO of Hermitage Capital Management in his 2006 HedgeWeek interview: Continue reading