In January last year, Reuters polled 1,000 oil market experts who basically agreed that oil would remain anchored in the $65-$70/bbl range through 2023. Only 3% of these experts thought that oil might rise to $90/bbl or more in 2020. I posted my analysis at this link: Market Fundamentals and Forecasting Groupthink. Later that year I published my own analysis, “Next Move in Oil Prices: $5-$10 Lower,” concluding that, …oil price will likely see another leg down… with Brent falling toward high $40s and WTI toward low $40s. Continue reading

Category Archives: Market research

Perfect storm gathering: the three converging disruptions

In the near future, we are likely to experience severe consequences of three converging disruptions:

- Stock market crash

- Oil price shock

- Inflation

Since the last recession we’ve enjoyed the longest ever period of economic expansion with low interest rates, low inflation and subdued commodity prices. But this all could be coming to an end.

Bursting of the “everything bubble”

Throughout the west, unprecedented government and central bank stimulus programs helped inflate the current “everything bubble.” This is not a new phenomenon; monetary expansion always creates asset bubbles. The one thing we know is that without exception, asset bubbles ultimately burst. The examples are many and some of them made a mark in the collective conscious of entire generations, from the 1630s Tulip Mania to the 1990s dot-com bubble. Continue reading

Sack your quant!

Last few years saw something of a gold rush into quantitative investment strategies. Their appeal is obvious as a way to put discipline into trading and take the emotion and stress out. Quantitative strategies might even help improve performance. Here’s how Black Rock President Rob Kapito articulated the industry hopes:

“As people get the data and learn how to use the data, I think there is going to be alpha generated and, therefore, will give active managers more opportunity than they‘ve had in the past to actually create returns.” [1]

In pursuit of the great expectations, Black Rock assembled more than 90 scientists, 28 of them with PhDs and even went as far as poaching one of Google’s leading scientists, Bill McCartney to develop the BlackRock’s machine learning applications. In practice Black Rock’s and other firms’ results have proven to be a mixed bag at best and it seems that most quantitative strategies have tended to underperform or even generate losses. The question is, why? Continue reading

Do trend followers move markets? (they do).

A few months ago, when reviewing our trades on US Treasury futures, I was so delighted, I drafted a bragging article titled “How we knew yields would collapse?” summarizing the results of our trading. That performance was entirely generated by my I-System model, first built in 1999. I still find myself awestruck that this works… We generated profitable trades through both the bear and the bull market in bonds, literally without needing to know a single thing about the market fundamentals. The trades were strictly based on the knowledge framework built into the system more than 20 years ago (by the way, our strategies are still generating excellent signals in those same markets). Continue reading

The oil price shock: has it arrived?

Experts seldom expect surprises. In spite of the ever deepening economic and political uncertainties gripping most oil producing and oil consuming regions, most market experts surveyed last year predicted that oil price would fluctuate between $65 and $70 through 2023.

That forecast assumes that nothing unforeseen would happen over the next five years. Such an assumption, to put it politely, is unjustified and the list of reasons is long and complex, and it can be neither ignored nor wished away. Over the recent months I’d written a handful of articles on the subject of the ‘coming oil price shock.’ Here are the last three: Continue reading

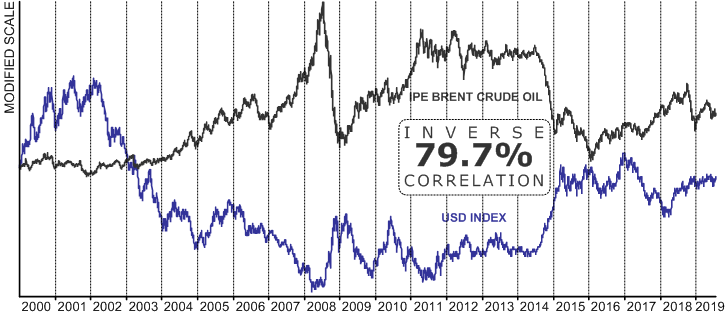

Failure of price forecasting: the unit of account conundrum

In addition to the better understood challenges of market analysis, like access to timely and accurate data, there is another – rather massive, but usually completely ignored – problem that renders forecasting largely an exercise in futility.

Over the years I’ve written quite a bit on the unreliable nature of price forecasts based on the analysis of market supply and demand . Most recently, in “Market fundamentals, forecasting and the groupthink effect,” I discussed the problem of data quality as well as the very real problem of groupthink among leading analysts, providing an example of a staggeringly wrong oil price forecast they produced. Some of the very same experts later produced this gem: Continue reading

Market fundamentals, forecasting and the groupthink effect

Last month I had the privilege of meeting with Jaran Rystad of Rystad Energy to discuss strategic cooperation between our companies. On the occasion, he gave me a rather detailed presentation of his firm’s energy intelligence database. I must say, in my 20+ years trading in commodities markets this is by far the most impressive product of its kind I’ve ever seen. Even from the software engineering point of view, I was very impressed. For full disclosure, nobody asked nor encouraged me to write this. Much as you’d recommend a restaurant where you ate well or a doctor you respect, I wholeheartedly recommend Rystad Energy as a provider of energy market intelligence as a matter of giving credit where credit is due.

Monaco, June 2019 – with Jarand Rystad

However, even with top notch data on economic supply and demand fundamentals, divining the future remains difficult and unlikely. John von Neumann rightly said that forecasting was “the most complex, interactive, and highly nonlinear problem that had ever been conceived of.” Continue reading

Trend following might save your tail

In the age of central bank quantitative easing, trend following has become an unpopular investment strategy, even earning tiself a bad name as trend following funds performed miserably compared to bonds, equities, and passive index funds. Below is a chart put together by AutumnGold showing a growing gap between Managed Futures funds the S&P 500 and Barclay’s Aggregate Bond index. Managed futures funds are a good proxy for trend following performance as most of them apply systematic trend following strategies in one way or another.

US jobs: everything is awesome! Is it? Let’s take another look.

A few years back in an interview with Wall Street Journal’s “Heard on the Street” program , Elliott Management’s Paul Singer said that his greatest worry was the rise of inflation that could appear suddenly. He suggested that this could come about with small changes in perception of inflation risk. Specifically, “The first whiffs of either commodity inflation or wage inflation,” said Singer, “may cause a self-reinforcing set of market events … which may include a sharp fall in bond prices, … fall in stock prices, rapid increase in commodities…”

Lessons Of Japan’s 1980s Bull Market

Afer popping, Japan’s 1980s bull market gave way to an 82% drop over the following 20 years.

Three decades later, Japanes equities are still more than 40% below peak valuations.

One of the most effective methods of navigating the boom/bust cycles has been the systematic trend following.

Sooner or later a crash is coming, and it may be terrific

Roger Babson, 5 Sep. 1929

If everybody indexed, the only word you could use is chaos, catastrophe. The markets would fail

Jack Bogle, founder of The Vanguard Group

As of December 2018, passive index funds controlled 17.2% of the stock of all U.S. publicly traded companies, up from only 3.5% in 2000. The 5-fold increase was in part the consequence of the ongoing stock market growth, which now has the distinction of being the longest running bull market ever recorded. Buoyed in large part by central banks’ unprecedented quantitative easing (QE) programs, the rising stocks have lulled many investors into complacency.