In addition to the better understood challenges of market analysis, like access to timely and accurate data, there is another – rather massive, but usually completely ignored – problem that renders forecasting largely an exercise in futility.

Over the years I’ve written quite a bit on the unreliable nature of price forecasts based on the analysis of market supply and demand . Most recently, in “Market fundamentals, forecasting and the groupthink effect,” I discussed the problem of data quality as well as the very real problem of groupthink among leading analysts, providing an example of a staggeringly wrong oil price forecast they produced. Some of the very same experts later produced this gem:

The EIA eventually gave up on specific price forecasts and opted instead for very broad-brush forecasts – as broad as $80 per barrel and more. But even those turned out useless. Then there are the famous Livingston Surveys seeking to predict asset prices, GDP and employment. Here are their stock market forecasts shortly before the global financial crisis and the bear market that ensued:

Highlighting failed forecasts may seem silly, but the reasons I single out the above examples is (a) because they were produced by some of the world’s most authoritative analysts, and (b) because they were so very widely off mark.

The unit of account conundrum

Price forecasts are always expressed in terms of a unit of account: USD, Euro, GBP, what have you. Almost without exception, the unit of account is assumed to be a stable and rock-solid foundation on which to measure the relative worth of output, consumption and investment. But currency is itself subject to fluctuation and can affect the nominal price of assets and commodities. Even if the supply and demand of any given commodity were fixed in perfect equilibrium, its price would likely still fluctuate because of the changes in relative value of the currency.

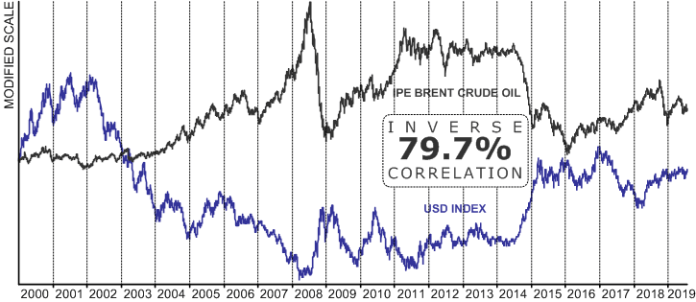

Take the example of oil again. Oil prices are usually expressed in terms of US Dollars per barrel. While it would be difficult to measure US Dollar’s impact on oil prices, we can easily measure their correlation. Over the past 20 years, there’s been an almost 80% inverse correlation between the US Dollar Index and the price of crude oil: as the dollar weakened, oil prices have tended to go up and as it strengthened, oil prices tended to fall. The relationship is quite apparent when we plot the two time series together:

Thus, the strength of the US dollar relative to other currencies strongly influences oil prices. This implies that oil price forecasting must also take into account the state of US economy, inflation, Federal Reserve’s monetary policy, government’s fiscal policies, etc. The number of relevant factors and the complexity of their interrelatedness easily overwhelms anyone’s ability to digest them, let alone produce consistently accurate forecasts.

All this should incline market participants to seriously consider the one credible and effective alternative to price forecasting: trend following. I’ve written a series of articles on this subject. Here’s a sample:

Trend following might save your tail

How trend following can help industry hedgers: the Palladium edition

Value investing vs. trend following: which is better?

Harnessing market trends to manage commodity price risk

My book, “Mastering Uncertainty in Commdities Trading” offers a more comprehensive treatment of the subject.

Alex Krainer [alex.krainer@altanawealth.com] is a hedge fund manager and commodities trader based in Monaco. He wrote the book “Mastering Uncertainty in Commodities Trading”