What’s needed is a sound intellectual framework for making decisions and the ability to keep emotions from corroding that framework

Warren Buffett

I-System: probably the very best trend following model ever built

Yes, this is a bold claim. But we have a 20-year continuity of using the I-System and audited track record to support it.

Uncertainty: the ultimate challenge in trading and investing

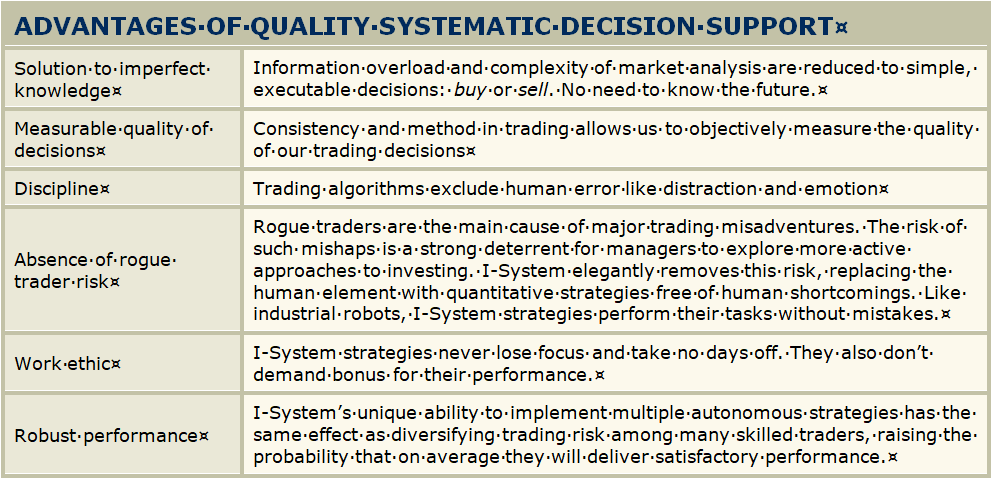

The most difficult problem facing all traders, investors and hedgers is uncertainty. Empirical data shows that most of them by far either lose money or underperform. This is partly due to the insufficiency of conventional ways of managing uncertainty.

Forecasting based on the analysis of economic fundamentals has proven ineffective at improving trading decisions. To improve performance, many traders embraced quantitative strategies, but experience has shown them to be a mixed bag at best.

Thousands of ideas and algorithms are thrown against the markets each day but high quality, sustainable solutions are proving elusive and difficult to find. The one approach that’s proven effective over many decades is systematic trend following.

20 years of passionate, uncompromising devotion to quality and reliability

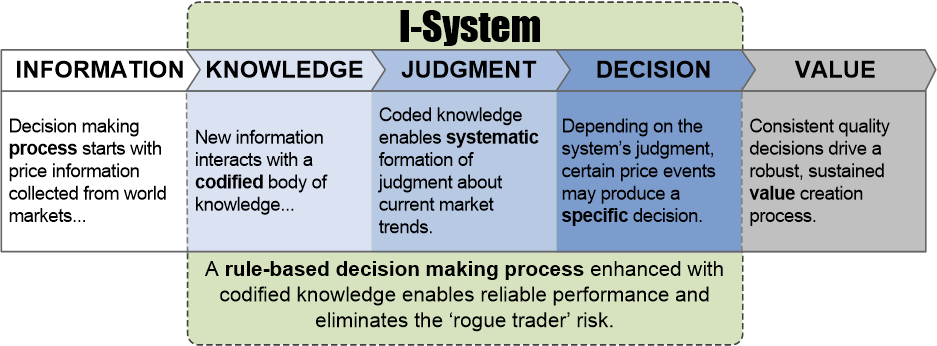

We’ve worked for over 20 years to create, refine and test the best trend following model achievable, applying the highest R&D standards and strictly adhering to best practices in software engineering. The result of our efforts is I-System, an A.I. framework of codified knowledge in market analysis and trading.

We designed the I-System so we can formulate, test aind implement thousands of autonomous trend following strategies in any market security.

A dependable trends auto-pilot

Quite simply, I-System is a dependable, time-tested trends auto pilot. Over the years, it has proven supremely reliable as well as effective: since 2003 it has functioned continuously with zero code tinkering, alterations, interruptions or maintenance issues. Since the start of our track record in 2007 it has consistently outperformed the relevant strategy benchmarks, including world’s top ranked, Blue Chip Commodity Trading Advisors (CTAs).

I-System provides reliable and effective guidance through the uncertainty of market fluctuations in more than one way – from our unrivalaled TrendCompass reports offering a wide variety of trading strategies covering more than 100 financial and commodity futures markets, to our portfolio and hedging solutions for professional investors and traders.

I-System’s ultimate potential

I-System is a robust, reliable solution to the problem of uncertainty, arguably the most difficult problem in speculation. I-System can ultimately transcend uncertainty, not by divining the future by replacing uncertainty with a more predictable asset class: a swarm of autonomous intelligent agents that generate positive expectancy decisions with utmost consistency, free from emotion and distraction. “Positive expectancy” implies that I-System strategies tend to generate value over time.