A spat at the UN Security Council shows the contrast between two very different approaches to war and to peace

[Originally published on Alex Krainer’s Substack] On 26 October 2023 at the United Nations Security Council an interesting exchange between the representatives of Israel and China followed China’s vetoing of the latest US-sponsored UNSC Israel/Palestine resolution. Israel’s permanent representative to the UN, Gilad Erdan delivered an abrasive, undiplomatic reprimand:

“To those who voted against this resolution I must say that your decision shocks me to my core. In Israel, we are fighting for our very survival. My elderly parents living in Ashkelon have spent the last 20 days running back and forth to their bomb shelters as rockets rained down on them, deliberately on them, on civilians. And you cannot condemn even these deliberate attacks on civilians perpetrated by terror organizations? If any of your countries endured a similar massacre, I am certain – certain, that you would act with much greater force than Israel. Much greater force!

Read more: Courting Armageddon vs. cultivating peaceThere would be no question in your minds that such a barbaric slaughter requires a broad military operation against the terrorists who committed such inhumane atrocities to eradicate their terrorist capabilities in order to make sure that such atrocities can even happen again. How would Moscow react if terrorist death squads wiped out entire neighborhoods in Moscow? How would Beijing respond if a genocidal jihadis beheaded and murdered your babies? I will give you a moment to reflect on that thought. But I believe every person, not only here in this room, across the globe, whoever is watching this discussion, knows exactly how you would respond.”

China’s permanent representative Zhang Jun‘s response was very measured and diplomatic, but I will skip it here. You can see the whole exchange in the 4-min. YouTube clip below:

What I found more interesting was that if Mr. Erdan’s remarks were intended to justify Israel’s actions by suggesting that others would react with “much greater force,” they certainly missed their mark.

How Russia responded to Ukraine’s “anti-terror operation” in 2014

We can contrast Israel’s rash and impulsive response to Hamas attacks to the way Russia responded to Ukraine’s 2014 “anti-terrorist operation” (ATO) against the Russian-speaking population in the south and in Donbass. Starting in late April that year, Ukraine’s regular troops, seeded with extremist elements from the Right Sector and other far-right paramilitary organizations descended with tanks, armored personnel carriers, heavy artillery, helicopters and aircraft on the Donbass and the cities of Slavyansk, Mariupol, Krasnoarmeisk, Kramatorsk, Donetsk, Lugansk and many smaller towns and villages.

By saying that Ukraine’s troops were “seeded with extremists,” I mean that when the initial attempts at repression turned out ineffective because Ukraine’s regular troops weren’t keen on unleashing violence on their fellow citizens, the Kiev junta hastily dispatched two or three members of different neo-Nazi gangs to all the mobilized units to enforce the junta’s orders, steel the troops’ resolve, and stir the pot properly to provoke a reaction from Russia.

Kiev’s first “success” was a massacre of Russian speaking protesters in Odessa on 2 May 2014. In addition to the 46 people who were burnt alive in the Trade Unions building that day, another 90 men, women and children were killed. The mass casualty event was planned and orchestrated deliberately. The unofficial casualty count was as high as 200 people. But that was only the beginning: over the ensuing weeks, Kiev’s troops killed more than 2000 Russian speaking Ukrainians (as officially tallied up in mid-July 2014 by Kiev’s government).

Giving peace every chance

Contrary to what Mr. Erdan suggested, Russia’s leadership did not react with “far greater force.” No Kremlin representative called Ukrainians “human animals” nor flattened any part of Kiev in anger. Instead, Vladimir Putin’s government called for peace. They maintained open lines of communications with Kiev and called for discussions with representatives of western powers. At Russia’s initiative, peace negotiations ensued with Geneva Accords, followed by Minsk I and Minsk II agreements. Russia’s government continued to work the diplomatic tack for 8 long years even as Kiev troops continued with daily shelling of towns and cities in the Donbass, killing a total of 14,000 people.

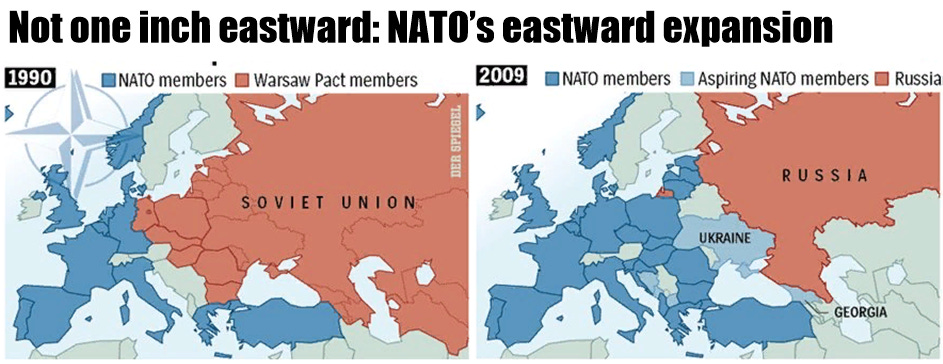

Before resorting to military means, the Kremlin proposed draft security agreements to the United States and NATO in December 2021. Even after the start of their “Special Military Operation” (SMO) in February 2022, the Russians continued to negotiate with Zelensky’s government in Kiev. Those negotiations very nearly yielded an agreement only a month into the military operation, but for the British Prime Minister Boris Johnson‘s intervention to make sure that peace didn’t break out in Ukraine.

Selective brutality, no reactions in anger

And while western media have been uniformly hostile to Russia, condemning its operations in Ukraine as barbaric and brutal, Russian brutality has been selective and strictly limited. Russia also did not react in anger against Israel when it caused the downing of its military aircraft over Syria killing 15 Russian officers. It also did not retaliate when Turkish air force downed its aircraft, nor when Azerbaijani forces did the same only hours before the 2020 signing of a peace deal between Azerbaijan and Armenia brokered by Russian diplomats. The peace deal was still signed in spite of someone’s attempt to derail it.

Russia also kept its cool when a passenger jet carrying 224 Russian tourists was shot down over Sinai desert in 2015 and when 9 of its diplomats were assassinated (or died suddenly and unexpectedly) around the world in quick succession, including its Ambassador in Ankara and its UN Ambassador Vitaly Churkin. For the record, these unexpected deaths occurred before the pandemic.

Statesmen with nuclear weapons shouldn’t indulge in juvenile tantrums

In all, Mr. Erdan’s remarks at the UNSC yesterday reflect an emotionally charged moment and perhaps justifiable outrage. But at high levels in diplomacy and government, officials have a responsibility to guard against rash, reckless reactions that jeopardize peace and risk escalating hostilities. It is understandable that many people at such times thirst for vengeance and disregard risks and consequences. But statesmen should not succumb to the emotion of the moment.

This should have double weight on Israeli leadership today, since their actions risk precipitating a regional war that could easily escalate to an uncontrollable global conflict with unpredictable consequences. Indulging an emotional, impulsive pursuit of revenge by a government whose arsenal includes as many as 400 nuclear bombs is reckless and irresponsible in the extreme. It is high time for Israeli leadership to sober up and finally seek a constructive path to peace and stability in its region.

Alex Krainer – @NakedHedgie is the creator of I-System Trend Following and publisher of daily TrendCompass investor reports which cover over 200 financial and commodities markets. One-month test drive is always free of charge, no jumping through hoops to cancel. To start your trial subscription, drop us an email at TrendCompass@ISystem-TF.com

For US investors, we propose a trend-driven inflation/recession resilient portfolio covering a basket of 30+ financial and commodities markets. For more information, you can drop me a comment or an email to xela.reniark@gmail.com