CBDCs are an expression of bankers’ fantasy of total control. Their first pilot program lasted 108 days and ended in total failure, lost elections and prison time.

This post was originally published on Alex Krainer’s Substack

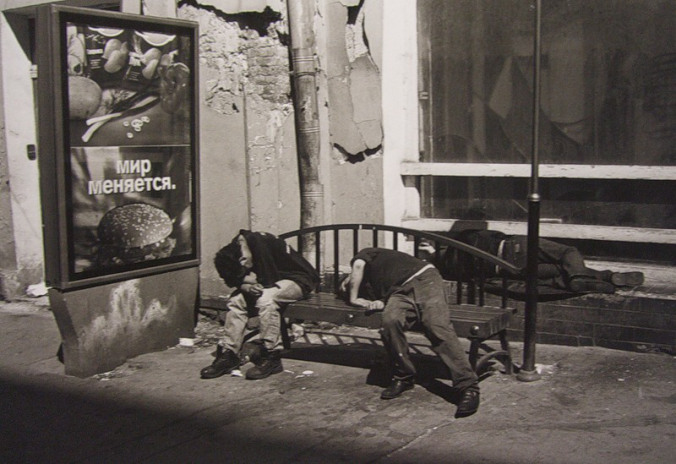

Will the dreaded Central Bank Digital Currencies (CBDCs) become a thing? Will they be as awful as the ruling parasite class has intended? Will they be able to enforce compliance with whatever rule they choose to impose, oppressing us under a draconian system of arbitrary restrictions and prohibitions? Rest assured, they will not.

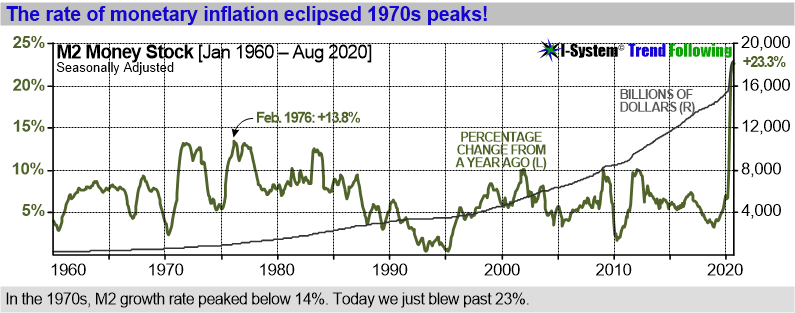

Over the last few months I was asked about CBDCs in a number of podcast interviews. The questions generally reflect the unease and anxiety about the prospect of finding ourselves in a totalitarian dystopia. CBDCs would allow our banking overlords to ‘see’ every purchase we make and condition our access to money through a system of permits that would enable them to micromanage any and all of our transaction choices in real time. This is what they mean when they say, “programmable” CBDCs.

Continue reading