- This week Sinopec disclosed the latest hedging mishap, losing $690 million amid last year’s oil price collapse.

- Unless price risk management is organized as an integral part of core business operations, it can devolve into eratic and risky game of speculation that can cause massive damage.

- The six simple but important guiding principles could help commodity firms create a world class risk management process and turn price risk into a source of value and competitive advantage.

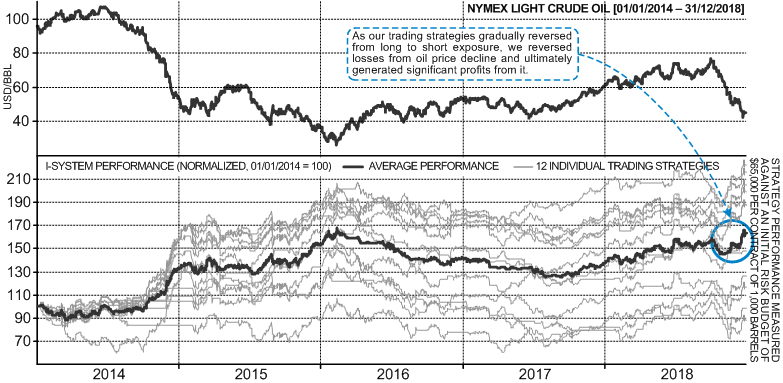

This week Sinopec disclosed that it had incurred $690 million in losses in the fourth quarter of 2018. The losses were attributed to Unipec’s oil hedging bets. Unipec clearly took the wrong directional exposure to oil prices in the period when they staged a sharp, 40% collapse (October-December 2018). This much is understandable. However, such losses did not need to happen – I maintained heavy exposure to oil prices over the same period and not only avoided heavy losses but actually generated significant profits by simply adhering to a systematic trend-following model.