Our future is being shaped by an unprecedented monetary experiment run by our central bank mandarins, but a happy ending is a mathematical impossibility. The economic imbalances that resulted in the last, 2008 financial crisis are now much worse and we are facing two possible routes of their resolution. One is a full-blown deflationary depression that could see asset prices drop by 50% or more. The other is a strong and sustained decline in the US Dollar (and other major currencies) with an accelerating commodity price inflation that might span a full decade.

Central banks’ overt commitment to supporting asset prices at all costs suggests that the second scenario may be more probable. In this case, a major stock-market crash could be averted; instead, we could see a significant and sustained rise in equity markets, as was the case most recently during the Zimbabwean and Venezuelan inflations, as well as the Argentinian, Brazilian, Israeli and German inflations before that. Below is the chart showing the appreciation of Israel All Share index during the country’s inflationary crisis in the 1980s:

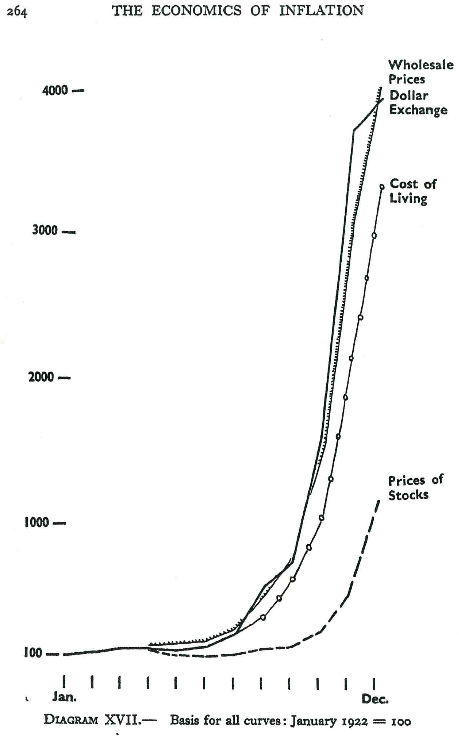

While at first blush this seems like good news for equity investors, it is not, as in each case investors and savers suffered very significant destruction of wealth. As the above chart shows, Israeli stock market index rose “only” to about 750,000 index while the CPI rose to more than 1,000,000. The reasons for this are best illustrated by the chart compiled by prof. Costantino Bresciani-Turroni in his encyclopedic volume, “The Economics of Inflation – A Study of Currency Depreciation in Post War Germany” [1]

As we can see, wholesale prices rose nearly four-fold compared to stock market prices. This suggests that in order to achieve a more effective inflation hedge, investors should seek exposure to “wholesale prices” – i.e. commodity prices.

The best, easiest, most transparent and most effective way of achieving this is through commodity futures. In addition to providing an effective inflation hedge, such vehicles provide another very important advantage for investors: they can prove to be the invaluable liquidity piggy banks at times when liquidity dries up and certain categories of funds throw up gates and limit redemptions.

For sure, there’s a bumpy ride ahead of us and investors will do well to assume higher levels of volatility. Complacency in the business-as-usual investment strategies will likely prove far more risky than they appear. In fact, they call to mind the picture of rearranging the deck-chairs on the Titanic as she was taking on water…

Notes:

[1] “Post War” in Bresciani-Turroni’s book refers to World War I – the book was first published in 1931.

Alex Krainer is an author and hedge fund manager based in Monaco. Recently he has published the book “Mastering Uncertainty in Commodities Trading“.

Pingback: Parabolic markets may signify onset of high inflation | The Naked Hedgie